Megan Woissol | September 19, 2022

Have you ever asked yourself, “Why should I buy a house?”

Besides the obvious reasons, like freedom in your dwelling (i.e. having no landlord to obey), tax benefits, and savings, there’s another reason you may not have considered.

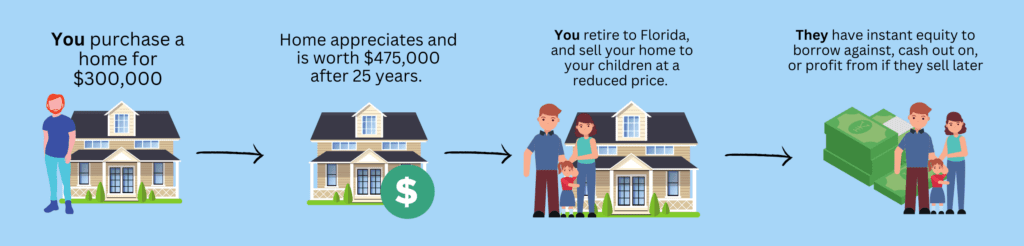

Being able to pass financial stability on to your children is something many people never get to do. For the average person, saving money doesn’t cut it – even with a high yield savings account. Purchasing a property can be the start of financial freedom that lasts for generations!

Imagine this: You own 3 properties. Later on, your children will inherit those properties, which they can then sell for a profit (assuming you paid off the original loan), or keep in the family as a family home. Perhaps they’d even keep the properties and rent them out, and have a steady stream of monthly income! The possibilities are endless.

“Time in the market beats timing the market”

ken fisher

If you have dreams of investing in real estate, but you’re waiting until the market “shifts,” you may be waiting a very long time. Like many other kinds of investments, values can fluctuate. However, unlike other kinds of investments, real estate is an appreciating asset, so if you purchase now, you’ll have more equity over the years than if you decide to wait, and equity can be leveraged – borrowed against, cashed out, or profited on if you sell.