Megan Woissol | November 19th, 2022

Mortgage interest rates are a hot topic of conversation right now. The COVID-19 Pandemic greatly impacted the housing market and mortgage interest rates. Now, as things return to pre-COVID normal, many borrowers are fearful of rising mortgage interest rates and what that means for purchasing a home. Some have decided that they want to wait until rates go back down to buy. Unfortunately, it is not known when or if rates will go down again. Trusted economists and housing experts throughout the nation tend to agree that it is not expected. According to Forbes, forecasts from the Economy Forecast Agency (EFA) predict mortgage rates of 11% by the end of 2023. Fannie Mae’s predictions range from 6.3% to 6.6% on average in 2023.

In either case, it seems now might be a great time for many buyers to take the leap and lock in today’s rates. And if you’re wishing for a lower rate than your qualifying rate, there are a few options.

#1 – Rate Buydowns

There are a few programs that allow you to buy down your interest rate. All of them involve cash being paid at closing to lower your interest rate, either for a few years or for the life of the loan.

3-2-1 or 2-1 Buydowns

A 3-2-1 Buydown will give you a 3% lower interest rate during the first 12 months of the loan, decreasing to 2% lower from month 13 to 24, and 1% lower from month 25 to 36. At the end of 3 years, your rate will revert back to your original qualifying rate. For example, if your qualifying rate was 6.5%, your first year’s rate will be 3.5%, 4.5% on year 2, and 5.5% on year 3, before finally increasing to 6.5% when the buydown expires at the beginning of the fourth year.

A 2-1 Buydown is similar, but it gives you a 2% lower rate throughout the first year, and 1% lower during the second, before increasing to your original qualifying rate as third year begins.

Permanent Rate Buydowns

Permanent buydowns lower the interest rate of the loan for the life of the loan. This type of buydown costs more than the other two; you should discuss all buydown options with your Loan Originator to determine which is the right one for you.

In today’s market, many buyers utilize seller concessions to buy down their rate. This is an option that your realtor can assist you with.

#2 – Program Options

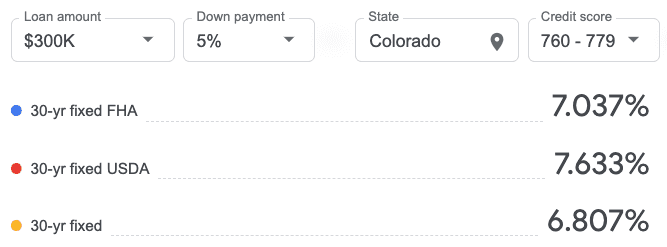

Considering a different loan program could help you get a lower interest rate. FHA, USDA, Conventional, and VA Loans all tend to have different interest rates. Generally, those eligible for a VA Loan use it, so we’ll use FHA, USDA, and Conventional for this example. In this figure, you can see how interest rates on the different programs can vary.

There are also differences in interest rates between the different types of adjustable rate mortgage programs, plus the initial rate starts out lower and increases over time.

Another option to obtain a lower interest rate is to choose a 15 year program option. FHA, Conventional, USDA and VA all offer 15 year mortgage loan options and the interest rates on them are lower than the standard 30 year term mortgage. However, there is a trade-off as the payment itself is higher.

#3 – Increased Credit Score

Since your credit score plays a role in your mortgage rate, you should have a conversation with your Loan Originator to determine if raising your credit could be beneficial. With some loan programs, you are considered credit “elite” if you have a 780 credit score or higher. With others, maximum loan interest rate benefit is reached with a 720 credit score or higher. If your credit is already qualifying you for the lowest possible rate, this will not be an option for you.

Once you have purchased your new home, you will have the opportunity to refinance after 6 months (or 12, in some cases). The average homeowner refinances their home 5-7 times over the life of the loan, but there is no limit to the number of times you can refinance your mortgage. If your current rate is of concern and rates have recently dropped, you should have a conversation with your Loan Originator about refinancing so they can advise you on potential savings, as well as total overall costs, and any drawbacks there might be.

*Disclaimer: These mortgage rates are illustrations only. They are estimated by a third party using industry averages for owner-occupied properties and do not include refinancing options. Actual rates may vary based on availability and lender approval. Interest rates are subject to change daily and without notice. Current interest rates shown are indicative of market conditions and individual qualifications and will vary upon your lock-in period, occupancy, loan type, credit score, purpose and loan to value and lending source.

*Available in AL, CO, DC, FL, GA, MD, PA, VA